Local 521, Service Employees International Union, and representatives of the County of San Mateo have met and conferred in good faith regarding wages, hours and other terms and conditions of employment of employees in the representation units listed in Section 1, have exchanged freely information, opinions and proposals and have endeavored to reach agreement on all matters relating to the employment conditions and employer-employee relations of such employees. This Memorandum of Understanding (MOU) is entered into pursuant to the Meyers-Milias-Brown Act (Government Code Sections 3500-3510) and has been jointly prepared by the parties.

Local 521, Service Employees International Union, hereinafter referred to as the “Union” or “SEIU 521”, is the recognized employee organization for the representation units listed below, certified pursuant to Resolution No. 38586, adopted by the Board of Supervisors on May 16, 1978.

(1) Accounting and Administrative Services Unit

(2) Appraisal Unit

(3) Office and Technical Services Unit

(4) Engineering Unit

(5) Library Unit

Effective the first full pay period following Board of Supervisors approval of this successor MOU, a salary differential of Seventy Dollars ($70.00) biweekly shall be paid to incumbents of positions requiring bilingual proficiency as designated by their respective Department Heads or their designee. Said differential shall be prorated for employees working less than full-time or who are in an unpaid leave of absence status for a portion of any given pay period.

An employee may submit a request for bilingual pay to their Department Head or designee. Upon receipt of an employee request for bilingual pay, the Department Head or designee shall approve or deny the request within thirty (30) calendar days. If the Department Head or designee does not respond within thirty (30) calendar days, the employee may submit the request to the Human Resources Director or designee, who will approve or deny the request within thirty (30) calendar days. Within one (1) week of approval, the County shall contact the bilingual examiner and offer the employee appointment dates and times for the bilingual examination.

Bilingual pay is effective the first pay period after Human Resources certifies the result of the bilingual exam. Human Resources may approve retroactivity for bilingual pay on a case-by-case basis.

Designation of positions for which bilingual proficiency is required is the sole prerogative of the Department and is based on operational and staffing needs of the Department. Human Resources will oversee the bilingual examination, certify exam results and determine effective date of bilingual pay of any individual submitted by the Department for testing. The Union shall be provided listings of employees receiving bilingual pay on a biweekly basis.

If an employee who has not been designated/approved for bilingual pay is required by the Department to perform bilingual services, the employee may report this issue to Employee Relations, who will investigate the matter within thirty (30) calendar days.

Individuals who promote or transfer to another position or Department will be reevaluated by the receiving Department to determine if bilingual pay should be continued. Should bilingual pay be continued, the Department must submit a request for continuation with the Human Resources Department.

If any employee’s request for bilingual pay consideration is denied by the Department, such denial shall be subject to appeal to the Human Resources Director whose decision shall be final.

The County and the Union agree to meet and confer, at the request of either party, to make appropriate changes to the above lists based upon the factors discussed in this section and/or to discuss other related issues such as employees required to use bilingual skills while performing job duties outside of their assigned classifications. At the request of the Union, the County will meet with the Union to discuss the need for additional bilingual positions.

11.1 Hiring and Selection

The County will continue to recruit and hire employees based on a specific need for bilingual skills. Within thirty (30) days of hire, the employee’s Department Head or designee shall submit a Bilingual Salary Differential Allowance form to the Bilingual Pay Coordinator. If the Department Head or designee does not submit the form within thirty (30) calendar days, the employee may submit a request to the Human Resources Director or designee, who will submit a Bilingual Salary Differential Allowance form to the Bilingual Pay Coordinator within thirty (30) calendar days. Within one (1) week of approval, the County shall contact the bilingual examiner and offer the employee appointment dates and times for the bilingual examination.

11.2 Testing

All employees hired to fill positions requiring bilingual skills will be tested for bilingual proficiency. Present employees may be certified by the appointing authority as possessing sufficient bilingual skills to be appointed to a bilingual pay position; provided, however, nothing herein precludes the County from requiring that said employees be tested. Requests by employees to be tested for bilingual skill proficiency will be referred to the Human Resources Director or his/her designee whose decision shall be final.

11.3 Continued Use of Bilingual Language Skill

Employees hired to fill positions requiring bilingual skills may be required to remain in bilingual pay positions. Employees who were selected to fill positions requiring bilingual skills during the implementation of the bilingual program will be allowed to voluntarily leave such positions provided management can reasonably replace said employees and there are sufficient positions within the classification that said employee can fill. Nothing herein precludes any of the above- specified employees from promoting to higher classifications.

11.4 Transfers

Transfers of employees occupying bilingual pay positions shall be in accordance with County policy and practice and shall not be in violation of the MOU. It is recognized that utilization of a bilingual skill may be the sole reason for transfer in order to meet a specific County need.

11.5 Review

The number and location of bilingual pay positions shall be periodically reviewed by management. If the number of filled positions in a specific division or geographical location are to be reduced, employees will be given reasonable notice prior to loss of the bilingual pay differential.

11.6 Administration

Administration of the bilingual pay plan will be the overall responsibility of Human Resources. Any disputes concerning the interpretation or application of the bilingual pay plan shall be referred to the Human Resources Director whose decision shall be final.

Except where indicated below, the County does not reimburse employees for home to work and work to home travel. Any disputes concerning the interpretation or application of the mileage reimbursement policy shall be referred to the Human Resources Director whose decision shall be final. After notification is received from the IRS indicating a change in its allowable mileage rate, the County will change its rate to coincide with the rate set by the IRS, as soon as possible.

Definition of Regular Work Location: The County facility(ies) or designated area(s) within the County where an employee reports when commencing their regularly assigned functions.

Any County facility(ies) or designated area(s) to which an employee is assigned for a period in excess of thirty (30) consecutive work days shall ordinarily be considered a regular work location and, as such, not subject to employee mileage reimbursement. Temporary assignments that extend beyond thirty (30) days may be considered for a mileage reimbursement eligibility extension not to exceed a total of twenty (20) additional work days. All approval authority for extensions rests with the Human Resources Director whose decision shall be final.

An employee is entitled to mileage reimbursement under the following conditions:

(1) Once an employee arrives at their regular work location, any subsequent work-related travel in the employee’s own vehicle shall be eligible for mileage reimbursement.

(2) Travel to Trainings and Conferences

a. If an employee uses their own vehicle for travel to and from any required training program or conference, the employee shall be entitled to mileage reimbursement for all miles traveled unless the employee is leaving directly from their residence, in which case the total shall be less the normal mileage to or from the employee’s regular work location.

b. If an employee uses their own vehicle for travel to and from any optional work-related training program or conference the employee may, with department head pre-approval, be eligible for mileage reimbursement up to the limits specified in paragraph “a” above.

(3) An employee who is required to travel from their residence to a location other than their regular work location shall be entitled to mileage reimbursement for all miles traveled less the normal mileage to or from their regular work location.

Example: An employee lives in Burlingame and regularly works in San Mateo – distance home to work is 8 miles. Due to an early meeting the employee must travel from home to Redwood City (21 miles). The employee is entitled to 13 miles of reimbursement. This figure is arrived at by subtracting 8 miles (normal mileage from home to work) from 21 miles (home to Redwood City).

(4) An employee who is required to engage in any work-related travel at the conclusion of which the employee’s workday will be completed shall be entitled to mileage reimbursement for all miles traveled less the normal mileage from the regular work location to their residence.

Example: An employee lives in Palo Alto and regularly works in Redwood City – distance home to work is 13 miles. The employee has a meeting at Hayward (31 miles) which ends at 5:00 p.m. and therefore, the employee will go directly home (31 miles). The employee is entitled to 18 miles of reimbursement. This figure is arrived at by subtracting 13 miles (normal mileage from home to work) from 31 miles (distance from Hayward to home).

Exceptions to the above policy may be considered on a case-by-case basis by the Human Resources Director, whose decision shall be final.

The County may reimburse employees for tuition and related fees paid for courses of study taken in off-duty status if the subject matter is closely related to the employee’s present or probable future work assignments. Limits to the amount of reimbursable expense may be set by the Human Resources Director with the County Manager’s concurrence. There must be a reasonable expectation that the employee’s work performance or value to the County will be enhanced as a result of the course of study. Courses taken as part of a program of study for a college undergraduate or graduate degree, or for courses taken as part of a program of study for a trades certificate at a bona fide institution of learning as required by the Fair Labor Standards Act, will be evaluated individually for job relatedness under the above criteria. The employee must both begin and successfully complete the course while employed by the County.

The employee must apply on the prescribed form to their department head giving all information needed for an evaluation of the request. The department head shall recommend approval or disapproval and forward the request to the Human Resources Director whose decision shall be final. In order to be reimbursed the employee’s application must have been approved before enrolling in the course. If a course is approved and later found to be unavailable a substitute course may be approved after enrollment. Upon completion of the course the employee must submit to Human Resources a request for reimbursement accompanied by a copy of the school grade report or a certificate of completion. Human Resources shall, if it approves the request, forward it to the Controller for payment. Reimbursement may include the costs of tuition and related fees. The County will reimburse up to $50.00 per course for books and other required course materials (excluding laptops and other electronic devices) under conditions specified in the Tuition Reimbursement program. Reimbursement for books will only be made for community college, undergraduate level or graduate level courses.

A probationary or permanent employee who has resigned in good standing or accepted a voluntary demotion may, within 2 years following the effective date of the resignation or voluntary demotion, request that the Human Resources Director place their name on the reinstatement eligible list for any classification for which they are qualified. Additionally, employees who occupy positions which the Department Head has determined are at risk of being eliminated may be placed on appropriate reinstatement lists prior to the anticipated date of layoff. This list may be considered by department heads in addition to either the promotional eligible or general lists but cannot take precedence over the department reemployment or general reemployment eligible lists.

15.1 Definition of Layoff

The County may lay off employees because of lack of work, lack of funds, reorganization, or otherwise when in the best interests of the County.

15.2 Notice of Layoff

The department head will give at least thirty (30) days advance written notice to the employees to be laid off except in an emergency situation in which case the Human Resources Director may authorize a shorter period of time. The County recognizes the impact of layoffs and will strive to give the impacted employees as much notice as possible.

The department head, or designee, will notice the impacted employees and the Union with an offer to meet with the Union. The meeting with the Union will occur as soon as possible.

15.3 Precedence by Employment Status

No permanent employee shall be laid off while employees working in extra-help, temporary, provisional, or probationary status are retained in the same classification unless that employee has been offered the extra-help, temporary, or provisional appointment. The order of layoff among employees not having permanent status shall be according to the following categories:

(1) Extra-Help or Seasonal

(2) Temporary

(3) Provisional

(4) Probationary – among probationary employees in a classification, order of layoff shall be by reverse order of seniority as determined by total continuous County civil service, not continuous time in that probationary period. Employees in flexibly-staffed positions serving a second probationary period (at a higher level classification in the series) shall not be considered probationary for layoff purposes.

Seniority

Layoffs shall be by job class, by department according to reverse order of seniority as determined by total continuous County civil service, except as specified above.

The following provisions shall apply in computing total continuous service:

(1) The following shall count as County service:

a. Time spent on military leave

b. Leave to accept temporary employment of less than one (1) year outside the County government, and

c. Leave to accept a position in the unclassified service.

(2) Periods of time during which an employee is required to be absent from their position by reason of an injury or disease for which they are entitled to and currently receiving Employees’ Compensation benefits shall be included in computing length of service for the purpose of determining that employee’s seniority rights.

(3) Time worked in an extra-help status shall not count as County service.

(4) Time worked in a permanent, probationary, provisional, or temporary status shall count as County service. Part-time status shall count at the rate of one year of continuous employment for each 2080 straight-time hours worked.

(5) If two (2) or more employees have the same seniority, the examination scores for their present classification shall determine seniority.

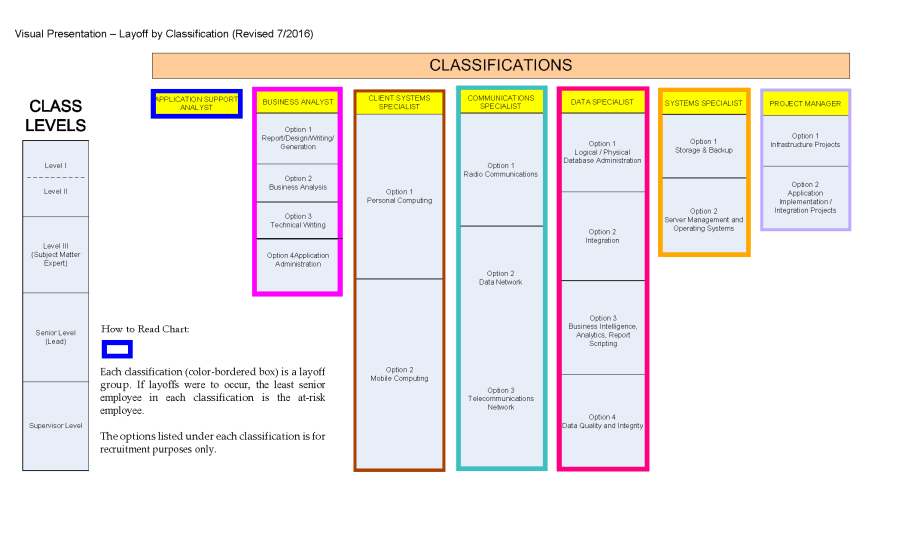

15.4 Identification of Positions for Layoff

(1) The classifications in a flexibly staffed series are treated as one classification for purposes of layoff.

(2) When a classification has formal numbered options, each of which specifies separate hiring criteria, each option shall be treated as a separate classification for layoff purposes.

15.5 Procedures

(1) A displaced employee will be afforded the opportunity to meet with a Human Resources representative, and a steward and/or SEIU 521 representative, to review their options under the established layoff procedures and receive additional support needed to navigate through the layoff procedures.

(2) A displaced employee will be transferred to any vacancy with equivalent FTE status in their classification in their home department.

(3) If no vacancy with equivalent FTE status exists in the employee’s classification in the home department, an employee shall have the right to interview for any other vacancies, County-wide, in their classification, or other classifications for which they have bumping rights. Employees who choose this option shall have a list of all such vacancies provided by the County. The County will arrange for interviews for vacancies in which the employee is interested.

(4) Employees who are notified they will be laid off shall have the choice to:

a. Take a voluntary demotion within the same department to any classification, at the employee’s discretion, in which the employee had prior probationary or permanent status provided such a position is held by an employee with less seniority.

b. On a departmental basis, displace the employee in the same classification having the least seniority in County service.

(5) Displaced employees may request the Human Resources Director to place their name on the promotional eligible list or open eligible list for any classification for which they are deemed qualified by the Human Resources Director or designee. The employee’s name will be above the names of persons who have not been displaced, ranked in the order specified in subsection 15.3.

(6) Pursuant to Rule XI, Sections 11 and 12 of the Civil Service Rules as revised, an employee may, with the approval of the Human Resources Director and the department head, demote or transfer to a vacant position for which they possess the necessary skills and fitness.

(7) A transfer, for layoff purposes, is defined as a change from one position to another in the same class or in another class, the salary range of which is not more than 10% higher.

(8) Part-time employees shall not displace full-time employees, unless the part-time employee has held full-time status in the class.

(9) In addition to all other options, employees in classifications at risk of being eliminated, as determined by the affected department head, may also be placed on the reinstatement list.

15.6 Names of Employees Laid Off to be Placed on Reemployment and General Eligible Lists

The names of employees laid off shall be placed on reemployment eligible lists as hereinafter specified. Former employees appointed from a reemployment eligible list shall be restored all rights accrued prior to being laid off, such as sick leave, vacation credits, and credit for years of service. However, such reemployed employees shall not be eligible for benefits for which they received compensation at the time of or subsequent to the date they were laid off.

The departmental reemployment eligible list for each class shall consist of the names of employees and former employees with probationary or permanent status who were laid off or whose positions were reallocated downward as a result of reclassification. The rank order on such lists shall be determined by relative seniority as specified in Section 15.3. Such lists shall take precedence over all other eligible lists in making certifications to the department in which the employee worked.

The general reemployment eligible list for each class shall consist of the names of employees and former employees with probationary or permanent status who were laid off or whose positions were reallocated downward as a result of reclassification. The rank order on such lists shall be determined by relative seniority. Such lists shall take precedence over all other eligible lists, except departmental reemployment eligible lists, in making certifications on a County-wide basis.

The provisions of this subsection 15.6 shall not apply to employees who have accepted severance pay upon termination of employment.

15.7 Abolition of Position

The provisions of this Section 15 shall apply when an occupied position is abolished.

16.1 Application

If an employee’s position is abolished and they are unable to displace another County employee as provided in Section 15, they shall receive severance pay of one week of pay for each full year (2080 hours) of regular service to the County, and, fifty percent (50%) of the cash value of the employee’s unused sick leave; provided, however that such employee shall be eligible for severance pay only if they remain in the service of the County until their services are no longer required by the department head. The County shall make every effort to secure comparable employment for the displaced employee in other departments. If such employment is secured, the employee will not be entitled to the aforementioned severance pay.

Severance pay as described in Section 16.1 shall not be denied because an employee refuses to take a position requiring twenty-nine (29) hours or less work per week.

16.2 Health Benefits Following Layoff

The County will pay the County share of the premium for nine (9) months of medical coverage only for employees who are laid off. This coverage is contingent on the following conditions;

(1) The employee has not refused a County job offer.

(2) The employee is unemployed.

(3) The employee continues to pay their share of the premium.

(4) The coverage is for health insurance only, and does not cover dental or vision insurance; and

(5) Such coverage runs concurrently with COBRA and CalCOBRA.

16.3 Educational Stipend

If an employee is laid off and not reemployed by the County through a transfer, demotion, or displacement of another employee, the County will pay up to four thousand dollars ($4,000) for tuition or fees in payment for accredited courses or training taken within twelve (12) months of layoff, and taken for the purpose of finding new employment. The administration of this new benefit will be determined by mutual agreement between the County and the Union.

17.1 Eligibility

Regular full-time employees in established positions shall be entitled to take all authorized holidays at full pay, not to exceed 8 hours for any one day, provided they are in a full pay status on both their regularly scheduled workdays immediately preceding and following the holiday. Part-time employees shall be entitled to holiday pay, not to exceed 8 hours for any one day, in proportion to the average percentage of hours worked during the two pay periods without holidays immediately preceding the pay period which includes the holiday.

17.2 Holidays

The holidays for the County are:

(1) January 1 (New Year’s Day)

(2) Third Monday in January (Martin Luther King, Jr’s Birthday)

(3) February 12* (Lincoln’s Birthday)*

(4) Third Monday in February (Washington’s Birthday)

(5) Last Monday in May (Memorial Day)

(6) June 19 (Juneteenth)

(7) July 4 (Independence Day)

(8) First Monday in September (Labor Day)

(9) Second Monday in October (Indigenous Peoples’ Day)

(10) November 11 (Veterans Day)

(11) Fourth Thursday in November (Thanksgiving Day)

(12) Friday following Thanksgiving Day

(13) December 25 (Christmas)

(14) Every day appointed by the President of the United States or the Governor of the State of California to be a day of public mourning, thanksgiving, or holiday. The granting of such holidays shall be discretionary with the Board of Supervisors.

*Effective February 2001, the Lincoln’s Birthday holiday was eliminated and replaced with a floating holiday (8 hours of holiday time) which will accrue on February 12. The floating holiday may be used starting in the first pay period that begins after February 12th, except as provided in Section 17.5. This provision shall not apply to employees of the Office of the District Attorney who shall continue to observe Lincoln’s Birthday as a holiday.

If the legislature or the Governor appoints a date different from the one shown above for the observance of one of these holidays, then San Mateo County shall observe the holiday on the date appointed by the Legislature or the Governor.

Court Holidays

Employees of the Office of the District Attorney will observe all Saturday holidays on the Friday preceding said holiday instead of being credited with a floating holiday.

Winter Recess Days

(1) Effective in December 2022 and December 2023, the County shall provide three (3) paid winter recess holidays (the equivalent of twenty-four (24) hours for a full-time employee) per year.

(2) For a three (3) day period designated by the County between December 26th and December 31st of 2022 and 2023, the County agrees to hold a Winter Recess. During the Winter Recess, County departments and divisions employing members of this SEIU collective bargaining unit may move to minimum staffing levels and/or close business, depending on the needs of the department and the public served. Which departments and divisions will close or go to minimum staffing and which bargaining unit members will be required to work is entirely within the discretion of the Appointing Authority or their designee. The determination for closure shall be made by the Department Head and subject to County Manager and Board of Supervisors’ approval.

(3) During the Winter Recess, regular full-time employees in established positions shall be entitled to eight (8) hours of full pay for each day of the three-day Winter Recess, provided they are in a full pay status on both their regularly scheduled workdays immediately preceding and following the holiday. Part-time employees shall be entitled to holiday pay, not to exceed eight (8) hours for any one (1) day, in proportion to the average percentage of hours worked during the two (2) pay periods without holidays immediately preceding the pay period which includes the holiday.

(4) If any of the Winter Recess days falls on a day the employee is not regularly scheduled to work, or if an employee is required to work on a Winter Recess day, the employee shall be entitled to equivalent straight time off with pay. “Winter Recess” exchange days shall be scheduled in the same manner as vacation, unless the department’s policy is to schedule vacation per a vacation sign up list, in which case these days shall be scheduled in the same manner as a Floating Holiday This equivalent time off is limited to twenty-four (24) hours. No employee will be allowed to have an accumulation of more than forty-eight (48) hours of Winter Recess time to their credit at any one time. If an employee leaves County service with accrued Winter Recess hours, those hours will be cashed out with terminal pay. Employees working on a Winter Recess day shall be compensated in accordance with the provisions of this MOU.

(5) Winter Recess hours will not be included as hours worked for the purpose of calculating overtime.

17.3 Holiday Falling on a Sunday

If one of the holidays listed above falls on Sunday, the holiday will be observed on a Monday. In County facilities where there is 24-hour per day coverage, employees in those facilities working such coverage shall observe holidays on the actual day of the holiday. Such employees assigned to work on a holiday will be compensated in accordance with Section 17.5.

17.4 Holiday Falling on Employee’s Regular Day Off

If any of the holidays listed above falls on a day other than Sunday and the employee is not regularly scheduled to work that day, or if an employee is required to work on a holiday, they shall be entitled to equivalent straight time off with pay. This equivalent time off is limited to one hundred twenty (120) hours with any time earned in excess of one hundred twenty (120) hours cashed out at the equivalent straight time rate. If an employee leaves County service with accrued holiday hours, those hours will be cashed out.

17.5 Hours Worked on a Holiday

Employees working on a holiday shall be compensated for such time worked at the rate of one and one-half (1 1/2) times the straight-time rate. This compensation may, at the employee’s option, be in the form of overtime pay or compensatory time off, but not a combination of the two.

In accordance with the leave approval provisions of Section 19.2, employees may use floating holiday time earned for Saturday holidays on the Friday immediately preceding the holiday. This is not intended to mean that management approval is not required for use of this time, but is intended to allow employees to use the floating holiday on the day before it is actually earned.

The County does not intend to prohibit employees from being absent from work on election days if employees can charge such time off to a floating holiday, accumulated vacation, or compensatory time. Every effort will be made to grant their requests unless the absences would be likely to create serious problems in rendering proper services to the public.

19.1 Vacation Allowance

Employees, excluding extra-help or as herein otherwise provided, shall be entitled to vacation with pay in accordance with the following schedule. Part-time employees except extra-help shall be entitled to vacation accruals on a pro‑rated basis.

Effective the first full pay period following Board approval of a successor MOU, vacation accrual shall be as follows:

(1) During the first 5 years of continuous service, vacation will be accrued at the rate of 4.0 hours per biweekly pay period worked.

(2) After the completion of 5 years of continuous service, vacation will be accrued at the rate of 5 hours per biweekly pay period worked.

(3) After the completion of 10 years of continuous service, vacation will be accrued at the rate of 6 hours per biweekly pay period worked.

(4) After the completion of 15 years of continuous service, vacation will be accrued at the rate of 7 hours per biweekly pay period worked.

(5) After the completion of 20 years of continuous service, vacation will be accrued at the rate of 8 hours per biweekly pay period worked.

(6) After completion of 25 years of continuous service, vacation will be accrued at the rate of 9 hours per biweekly pay period worked.

(7) No employee will be allowed to have an accumulation of more than fifty-two (52) biweekly pay periods vacation accrual to their credit at any one time. However, employees may accrue unlimited vacation time in excess of the maximum allowance when such vacation accrues because of remaining in a pay status during periods of illness or injury which precluded liquidating vacation credits earned in excess of the maximum allowed.

(8) No vacation will be permitted prior to completion of thirteen (13) biweekly pay periods of service.

(9) Vacation may be used in increments of six (6) minutes.

(10) Extra-Help do not accrue vacation credits, except that prior extra-help service shall be included with service in a regular established position in computing vacation allowance for the purpose of this Section. Such service as extra-help may not be included if it preceded a period of over twenty-eight (28) consecutive calendar days during which the employee was not in a pay status, except if approved by the Human Resources Director.

19.2 Vacation Schedule

The time at which employees shall be granted vacation shall be at the discretion of the appointing authority. Length of service and seniority shall be given consideration in scheduling vacations and in giving preference as to vacation time. The Employee Relations Division agrees to investigate and, if appropriate, to ensure that an employee be allowed to take vacation time off when the employee is at the maximum vacation accrual amount. The decision of the Employee Relations Manager shall be final.

19.3 Vacation Allowance for Separated Employees

When an employee is separated from County service their remaining vacation allowance shall be added to their final compensation.

The Union agrees that it has the duty to provide fair and non-discriminatory representation to all employees in all classes covered by this MOU regardless of whether they are members of the Union.

2.1 Reinstatement

Employees that are separated from the representation unit shall be reinstated upon the employee’s return to the representation unit. For purpose of this Section, the term separation includes transfer out of the representation unit, layoff, FMLA leave, workers comp absence and any leave of absence with or without pay.

2.2 Payroll Deduction

The County shall deduct Union membership dues and any other mutually agreed upon payroll deduction including voluntary COPE checkoff, from employees’ paychecks under procedures outlined in this section, as prescribed by the County Controller. The deduction shall be made only after the Union certifies to the County a list of employees who have authorized such deductions.

Where the County receives employee requests to cancel, revoke or change deductions, the County will direct employees to the Union. Employees may authorize dues deductions only for the organization certified as the recognized employee organization of the unit to which such employees are assigned and for the COPE Fund. All employees in the unit who have authorized Union dues, shall have such deduction continued and shall be made only upon signed authorization from an employee and only after the Union certifies to the County a list of employees who have authorized such deduction(s).

2.3 County Obligations

(1) All dues and COPE deductions shall be transmitted to Local 521 in an expeditious manner.

(2) All transmittal checks shall be accompanied by documentation which denotes the employee’s name, employee’s number, amount of deduction (including COPE) and member status.

(3) Forfeiture of Deduction: If, after all other involuntary and insurance premium deductions are made in any pay period, the balance is not sufficient to pay the deduction of Union dues required by this Section, no such deduction shall be made for the current pay period.

2.4 Hold Harmless

The Union shall indemnify, defend, and save the County harmless against any and all claims, demands, suits, orders, or judgments, or other forms of liability that arise out of or by reason of this union security Section, or action taken or not taken by the County under this Section. This includes, but is not limited to, the County’s attorney’s fees and costs.

2.5 Communications with Employees

The Union shall be allowed by departments in which it represents employees the use of a designated bulletin board visible and accessible to employees for communications having to do with official organization business. The department involved and/or Employee Relations will investigate problems that the Union identifies with respect to the use of bulletin boards.

The Union may distribute materials to unit employees through County mail and email distribution channels as long as they remain in compliance with County policies. This privilege may be revoked in the event of abuse after Employee Relations consults with representatives of the Union. The content of any materials distributed to employees shall not relate to political activity or violate existing County policies.

Employees shall not prepare Union-related emails during County work time without first obtaining approved release time.

Any representative of the Union shall give notice to Employee Relations at least twenty-four (24) hours in advance when contacting employees during their duty period, provided that solicitation for membership or other internal union business shall be conducted only during the non-duty hours of all employees concerned. Pre-arrangement for routine contact may be made by agreement between the Union and the department head and when made shall continue until revoked.

2.6 Use of County Buildings

County buildings and other facilities may be made available for use by County employees or the Union or its representatives in accordance with such administrative procedures as may be established by the County Manager or department heads.

2.7 Advance Notice

Except in cases of emergency as provided below in this subsection the Union, if affected, shall be given reasonable advance written notice of any ordinance, resolution, policy, rule or regulation directly relating to matters within the scope of representation proposed to be adopted by the County and shall be given the opportunity to meet with appropriate management representatives prior to adoption.

In cases of emergency when the foregoing procedure is not practical or in the best public interest, the County may adopt or put into practice immediately such measures as are required. At the earliest practicable date thereafter the Union shall be provided with the notice described in the preceding paragraph and be given an opportunity to meet with the appropriate management representatives.

2.8 Employee Roster

The County shall supply without cost to the Union a bi-weekly electronic and sortable data processing run of the names, classifications, work locations, work, home, and personal cellular telephone numbers on file with the County, personal email addresses on file with the County, and home addresses on file with the County of all employees in the units represented by the Union. Such lists shall indicate hourly rates of pay, hours worked, gross pay, Union dues withheld from employees’ checks as of the date the roster was prepared, membership status, the names added to or deleted from the previous list, and whether each such change in status was due to any type of leave of absence, termination, layoff, reemployment after layoff, retirement, or withdrawal from the Union. The County shall notify the Union of employees who are on an unpaid status in excess of twenty-eight (28) days.

2.9 Third Party Notification

The County acknowledges the Union’s standing information request for notification in the event the County receives a Public Records Act request for bargaining unit contact information. The County will notify the Union of any such requests that are submitted to Human Resources.

2.10 New Employee Orientation

The County and the Union shall continue to work on best practices during the term of the agreement, to ensure labor access to new employees’ on-boarding and/or orientation for the purpose of educating them on their representation opportunities at the time of hire.

The County shall alternate in-person and remote New Hire Benefits Orientations and/or on boarding for new employees. All new employees are encouraged to attend within thirty (30) days of hire commencing employment. New employee Benefits Orientation is scheduled for every other week, and the Union will have up to thirty (30) minutes at the end of each session to provide information regarding its organization to its represented employees and members. One (1) member designated by the Union will be granted release time for this purpose, unless otherwise agreed to with Employee Relations. A non-employee Union Representative may also attend.

If the orientation is held online, the members designated by the Union may reserve available, private meeting space, provided it does not interfere with County business operations. If new employee orientation is held online, release time shall include set up time to attend the orientation.

The County shall provide the Union at least ten (10) days advance notice of a scheduled orientation. The Union will be copied on the New Employee Orientation invitation sent to SEIU-represented workers, which includes the names and email addresses of SEIU represented employees who will be attending the orientation.

For employees who do not attend an orientation within the first month of their employment, the Union can schedule up to thirty (30) minutes with each employee to meet directly with them to provide information. Such meeting may occur no later than ninety (90) days of hire. Release Time requested for this activity will be reviewed and approved by Employee Relations and the employee’s supervisor under normal Release Time processes.

If a new employee delivers a membership card to a Payroll Coordinator, the Payroll Coordinator will scan and email the form to the Union, followed by an original by mail. The County shall include the SEIU 521 designated membership card in the benefit enrollment packet/folder for all new employees.

The Union shall indemnify, defend, and save the County harmless against any and all claims, demands, suits, orders, or judgments, or other forms of liability that arise out of or by reason of the temporary acceptance and delivery of membership cards.

20.1 Accrual

All employees, except extra-help, shall accrue sick leave at the rate of 3.7 hours for each biweekly pay period of full-time work. Such accrual shall be prorated for any employee, except extra-help, who work less than full time during a pay period. For the purpose of this Section absence in a pay status shall be considered work.

20.2 Usage

Sick leave is accrued paid leave from work that can be used for any of the following purposes:

(1) Diagnosis, care, or treatment of the employee’s illness, injury, health condition, or exposure to contagious disease which incapacitates them from performance of duties. This includes disabilities caused or contributed to by pregnancy, miscarriage, abortion, childbirth, and recovery therefrom as determined by a licensed health care professional.

(2) The employee’s receipt of preventative care or required medical or dental care or consultation.

(3) The employee’s attendance, for the purpose of diagnosis, care, or treatment of an existing health condition of, or preventative care, on a member of the immediate family who is ill. For the purpose of this Section 20.2, immediate family means parent, step-parent, spouse, domestic partner, child, person for whom the employee is a legal guardian, sibling, step children, mother-in-law, father-in-law, grandparents or grandchildren.

(4) The employee’s preparation for or attendance at the funeral of a member of the immediate family.

For the purpose of preparation for or attendance at a funeral, immediate family includes parent, step-parent, step-parent in-law, spouse, domestic partner, child (including through miscarriage or stillbirth), person for whom the employee is a legal guardian, sibling, sibling-in-law, stepchildren, mother-in-law, father-in-law, son-in-law, daughter-in-law, grandparents, grandparents-in-law and grandchildren. Use of sick leave for this expanded definition is limited to a maximum of five (5) days if travel is required.

(5) The employee’s attendance to an adoptive child or to a child born to the employee or the employee’s spouse or registered domestic partner for up to six (6) weeks immediately after the birth or arrival of the child in the home.

Sick leave used concurrently with California Family Rights Act (CFRA) leave for the purpose of bonding following the birth, adoption or foster care placement of a child of the employee must be concluded within one (1) year of the birth or placement of the child. The basic minimum duration of such leave is two (2) weeks. However, an employee is entitled to leave for one of these purposes (e.g. bonding with a newborn) for less than two (2) weeks duration on any two (2) occasions.

(6) An employee who is a victim of domestic violence, sexual assault, or stalking may use up to one half (1/2) of their annual sick leave allotment to:

a. obtain or attempt to obtain a temporary restraining order or other court assistance to help ensure the health safety or welfare of the employee or their child; or

b. Obtain medical attention or psychological counseling; services from a shelter; program or crisis center; or participate in safety planning or other actions to increase safety.

20.3 Procedures for Requesting and Approving Sick Leave

When the requirement for sick leave is known to the employee in advance of their absence, the employee shall request authorization for sick leave at such time, in the manner hereinafter specified. In all other instances the employee shall notify their supervisor as promptly as possible by telephone or other means.

Before an employee may be paid for the use of accrued sick leave they shall complete and submit to their department head a request, stating the dates and hours of absence, and such other information as is necessary for the request to be evaluated. If an employee does not return to work prior to the payroll preparation, other arrangements may be made with the department head and Controller’s approval. The sick leave request shall be treated confidentially.

The department head may require a physician’s statement from an employee who applies for sick leave or make whatever investigation into the circumstances that appears warranted before taking action on the request. Employees who are absent from work because of illness or injury shall not be disciplined because they are unable to provide a physician’s certificate when said document has not been requested prior to the employee’s return to work.

An employee who has exhausted their accrued sick leave balance may use other accrued leaves (vacation, comp time, holiday credits), in lieu of sick leave which meets the criteria specified in Section 20.2, unless such employee has been documented by management for attendance problems within the last 4 months, in which case such other leaves may only be used for pre‑scheduled and pre‑approved medical and dental appointments. The use of such leave in lieu of sick leave is subject to all other provisions of Section 20.

See Section 37 regarding workers with an excessive number of unplanned absences.

20.4 Accounting for Sick Leave

Sick leave may be used in increments of 6 minutes.

20.5 Credits

When an employee who has been working in an extra-help category is appointed to a permanent position they may receive credit for such extra-help period of service in computing accumulated sick leave, provided that no credit shall be given for service preceding any period of more than 28 consecutive calendar days in which an employee was not in a pay status.

If an employee with unused sick leave accrued is laid off and later reemployed in a permanent position, such sick leave credits shall be restored upon reemployment. Employees shall not have any portion of sick leave credits restored for which they received compensation at the time of or subsequent to the day of layoff.

20.6 Incapacity to Perform Duties

If the appointing authority has been informed through a doctor’s report of a medical examination, that an employee is not capable of properly performing their duties, they may require the employee to absent himself/herself from work until the incapacity is remedied. During such absence the employee may utilize any accumulated sick leave, vacation, holiday and compensatory time.

20.7 Use of Sick Leave While on Vacation

An employee who is injured or who becomes ill while on vacation may be paid for sick leave in lieu of vacation provided that the employee:

(1) was hospitalized during the period for which sick leave is claimed, or

(2) received medical treatment or diagnosis and presents a statement indicating illness or disability signed by a physician covering the period for which sick leave is claimed, or

(3) was preparing for or attending the funeral of an immediate family member.

No request to be paid for sick leave in lieu of vacation will be considered unless such request is made within 10 working days of the employee’s return and the above substantiation is provided within a reasonable time.

20.8 Sick Leave During Holidays

Paid holidays shall not be considered as part of any period of sick leave, unless the employee is scheduled to work on that holiday.

20.9 Catastrophic Leave Program

(1) Purpose

The Catastrophic Leave Policy is designed to assist employees who have exhausted paid time credits due to serious or catastrophic illness, injury or condition of the employee or their family. This policy allows other employees to make voluntary grants of time to that employee so that s/he can remain in a paid status for a longer period of time, thus partially ameliorating the financial impact of the illness, injury or condition.

The County will prepare a modified policy Catastrophic Leave Policy. The County will present the proposed policy to all labor organizations, and will offer the opportunity to meet and confer as provided by law through a joint process involving all participating labor organizations.

(2) Program Eligibility

Leave credits may voluntarily be transferred from one or more donating employees to another receiving employee under the following conditions:

a. The receiving employee is a permanent full or part-time employee whose participation has been approved by their department head;

b. The receiving employee and/or the employee’s family member has sustained a life threatening or debilitating illness, injury or condition. (The department head may require that the condition be confirmed by a doctor’s report);

c. The receiving employee has exhausted all paid time off;

d. The receiving employee must be prevented from returning to work for at least thirty (30) days and must have applied for a medical leave of absence.

(3) Transferring Time

a. Vacation and holiday time may be transferred by employees in all work groups. Compensatory time may be transferred by employees in work groups 1, 4, and 5.

b. Sick leave may be transferred at the rate of 1 hour of sick leave for every 4 hours of other time (i.e., holiday, vacation, or comp time).

c. Donated time will be converted from the type of leave given to sick leave and credited to the receiving employee’s sick leave balance on an hour-for-hour basis and shall be paid at the rate of pay of the receiving employee.

d. Donations must be a minimum of 8 hours and, thereafter, in whole hour increments.

e. The total leave credits received by the employee shall normally not exceed three months; however, if approved by the department head, the total leave credits received may be up to a maximum of six months.

f. Donations approved shall be made on a Catastrophic Leave Time Grant form signed by the donating employee and approved by the receiving employee’s department head. Once posted, these donations are irrevocable except as described in paragraph 7 below.

g. In the event of the untimely death of a Catastrophic Leave recipient, any excess leave will be returned to the donating employees on a last in/first out basis (i.e., excess leave would be returned to the last employee(s) to have donated).

(4) Appeal Rights

Employees denied participation in the program by the department head may appeal the decision to the Human Resources Director whose decision shall be final.

20.10 Sick Leave for Childbirth and Adoption

Employees may use up to 30 working days of accrued sick leave following the birth or adoption of a child they will legally parent.

21.1 General

Employees shall not be entitled to leaves of absence as a matter of right, but only in accordance with the provisions of law and this MOU. Unless otherwise provided, the granting of a leave of absence also grants to the employee the right to return to a position in the same class, or equivalent class in the same department as they held at the time the leave was granted. The granting of any leave of absence shall be based on the presumption that the employee intends to return to work upon the expiration of the leave. However, if a disability retirement application has been filed with the County Retirement Board a leave may be granted pending decision by that Board. Nothing in this Section 21 shall abridge an employee’s rights under the Family and Medical Leave Act (FMLA), Federal, State or any other applicable Law. Information regarding FMLA is contained in the Letters section of this MOU.

Total Period of Leave: Except for Disability Leaves as provided above and in Section 21.4 (2) (c), no leave of absence or combination of leaves of absence when taken consecutively, shall exceed a total period of twenty-six (26) pay periods.

Approval and Appeals: Initial action to approve or disapprove any leave of absence shall be by the employee’s department head; however, leaves of absence of more than two (2) biweekly pay periods must also be approved by the Human Resources Director. Denial of requested leave in whole or in part at the department level may be appealed by the employee to the Director, whose decision shall be final.

21.2 Benefit Entitlement

Employees on leaves of absence without pay for more than two (2) biweekly pay periods shall not be entitled to payment of the County’s portion of health, dental, life, or long-term disability insurance premiums, except as provided hereinafter. The entitlement to payment of the County’s portion of the premiums shall end on the last day of two (2) full biweekly pay periods in which the employee was absent. An employee who is granted a leave of absence without pay due to the employee’s illness or accident shall be entitled to two (2) biweekly pay periods of the County’s portion of the insurance premiums for each year of County service or major fraction thereof, up to a maximum of twenty‑six (26) biweekly pay periods payment of premiums.

Where applicable, payment of the County’s portion of the insurance premiums described in this Section 21.2 shall count toward fulfillment of statutory requirements for payment of the County’s contributions toward health insurance under the Family Medical Leave Act (FMLA), California Family Rights Act (CFRA) and California Pregnancy Disability Leave (PDL).

21.3 Seniority Rights and Salary Adjustments

Authorized absence without pay which exceeds twenty-eight consecutive calendar days for either: (1) leave of absence for personal reasons, (2) leave of absence for illness or injury not compensated through Employees’ Compensation benefits, or (3) leave of absence to fill an unexpired term in elective office shall not be included in determining salary adjustment rights, or any seniority rights, based on length of employment. Any authorized absence without pay (regardless of length) which begins on or after October 24, 1994, shall not be included in determining salary adjustment rights, or any seniority rights, based on length of employment.

21.4 Job Incurred Disability Leave

(1) Job Incurred Disability Leave With Pay

a. Definition: Job incurred disability leave with pay is an employee’s absence from duty with pay because of disability caused by illness or injury arising out of and in the course of their employment which has been declared compensable under Workers’ Compensation Law. Only permanent or probationary employees occupying permanent positions are eligible for job incurred disability leave with pay.

b. Payment: Payment of job incurred disability leave shall be at the base pay of the employee, and shall be reduced by the amount of temporary disability indemnity received pursuant to Workers Compensation Law.

c. Application for and Approval of Job Incurred Disability Leave With Pay: In order to receive pay for job incurred disability leave an employee must submit a request on the prescribed form to their department head describing the illness or accident and all information required for the department head to evaluate the request. The employee must attach a physician’s statement certifying to the nature, extent, and probable period of illness or disability. No job incurred disability leave with pay may be granted until after the County, the County Workers Compensation Adjuster or the State Compensation Insurance Fund has declared the illness or injury compensable under the California Workers Compensation Law and has accepted liability.

d. Length of Job Incurred Disability Leave With Pay: Eligible employees shall be entitled to disability leave for the period of incapacity as determined by a physician, not to exceed a maximum of 90 calendar days for any one illness or injury. Holidays falling within the period of disability shall extend the maximum time allowance by the number of such holidays.

(2) Job Incurred Disability Leave Without Pay

a. Definition: Job incurred disability leave without pay is an employee’s absence from duty without County pay because of disability caused by illness or injury arising out of and in the course of their employment which has been declared compensable under Workers Compensation Law. Only permanent or probationary employees occupying permanent positions are eligible for job incurred disability leave without pay. Such leave is taken after the disabled employee has used up allowable job incurred disability leave with pay, as well as accrued credits for sick leave. At the employee’s option, vacation and compensatory time-off accruals may also be used.

b. Application for and Approval of Job Incurred Disability Leave Without Pay: In order to receive job incurred disability leave without pay an eligible employee must submit a request on the prescribed form to their department head describing the illness or accident and all information required for the department head to evaluate the request. The employee must attach a statement from a physician certifying as to the nature, extent, and probable period of illness of disability.

c. Length and Amount of Job Incurred Disability Leave Without Pay: Job incurred disability leave without pay may not exceed 26 biweekly pay periods for any one injury. The combined total of job incurred disability leave with pay and job incurred disability leave without pay for one accident or illness may not exceed 32 biweekly pay periods. In the event an employee is disabled and is receiving Employees’ Compensation benefits this leave may be extended as long as such disability continues.

21.5 Leave of Absence Without Pay

(1) General Provisions

a. Qualifying: Only permanent or probationary employees occupying permanent positions are eligible for leaves of absence without pay under the provisions of this Section.

b. Application for and Approval of Leaves of Absence Without Pay: In order to receive leave without pay, an employee must submit a request on the prescribed form to their department head describing the reasons for the request and all other information required for the department head, or their representative, to evaluate the request.

c. Granting of Leaves of Absence Without Pay: An appointing authority may grant leaves of absence without pay for up to a maximum of 2 biweekly pay periods. Leaves of absence of more than 2 biweekly pay periods must be approved by the Human Resources Director and shall be subject to review by the County Manager, whose ruling shall be final.

(2) Leaves of Absence Without Pay For Non‑Job Incurred Illness or Injury: Leaves of Absence without pay on account of illness or injury which are not job incurred may be granted for a maximum period of 26 full biweekly pay periods. This includes disabilities caused or contributed to by pregnancy, miscarriage, abortion, childbirth, and recovery therefrom. Such leaves will be granted only after all accrued sick leave credits have been used and shall be substantiated by a physician’s statement.

(3) Leaves of Absence Without Pay for Personal Reasons: Leaves of absence without pay for personal reasons (including but not limited to being employed on a full-time basis by the Union signatory to this MOU) may be granted for a maximum period of 13 full biweekly pay periods. Such leaves shall only be granted after all accrued vacation and holiday credits have been used; however, an employee may request in case of personal emergency, including an emergency relating to the non‑disability portion of maternity leave, that one week’s vacation be retained. The decision of the Human Resources Director shall be final.

(4) Parental Leave: An employee/parent of either sex shall be granted a leave of absence without pay to fulfill parenting responsibilities during the period of one year following the child’s birth or one year following the filing of application for adoption and actual arrival of child in the home. Such leave shall be for a maximum period of 13 biweekly pay periods. Use of accrued vacation, sick, compensatory time or holiday credits shall not be a pre‑condition for the granting of such parental leave. Employees who must assume custody of a minor will be eligible for parental leave.

21.6 Military Leaves of Absence

The provisions of the Military and Veterans Code of the State of California as well as the Uniformed Services Employment and Reemployment Rights Act (USERRA) shall govern military leave of County employees.

21.7 Absence Due To Required Attendance in Court

Upon approval by the department head, an employee, other than extra-help, shall be permitted authorized absence from duty for appearance in Court because of jury service, in obedience to subpoena related to the employee’s San Mateo County employment or by direction of proper authority, in accordance with the following provisions:

(1) Said absence from duty will be with full pay to a maximum of eight (8) hours for each day the employee serves on the jury or testifies as a witness in a criminal case, other than as a defendant, including necessary travel time. As a condition of receiving such full pay, the employee must remit to the County Treasurer, through the employee’s department head within fifteen (15) days after receipt, all fees received except those specifically allowed for mileage and expenses.

(2) Attendance in Court in connection with an employee’s usual official duties or in connection with a case in which the County of San Mateo is a party, together with travel time necessarily involved, shall not be considered absence from duty within the meaning of this Section.

(3) An employee required to appear in court in a matter unrelated to their County job duties or because of civil or administrative proceedings that he or she initiated does not receive compensation for time spent related to those proceedings. An employee may request to receive time off using vacation, compensatory, holiday or voluntary time off if accrued balances are available, or will be in an unpaid status, for time spent related to those proceedings. This provision does not apply to grievance proceedings pursuant to this MOU, San Mateo County Civil Service Commission proceedings, EAP or Peninsula Conflict Resolution Center (PCRC) mediation proceedings, or administrative proceedings related to the Meyers Milias Brown Act or the MOU between the parties.

(4) Any fees allowed, except for reimbursement of expenses incurred, shall be remitted to the County Treasurer through the employee’s department head.

21.8 Educational Leave of Absence With Pay

Educational leave of absence with pay may be granted to employees under the conditions specified in this Section. In order to be granted educational leave of absence with pay an employee must submit on the prescribed form a request to the appointing authority containing all information required to evaluate the request.

The County may, after approval of an employee’s application, grant a leave of absence with pay for a maximum of 65 working days during any 52 biweekly pay periods for the purpose of attending a formal training or educational course of study. Eligibility for such leaves will be limited to employees with at least thirteen (13) biweekly pay periods of continuous service and who are not extra-help, or temporary. Such leaves will be granted only in cases where there is a reasonable expectation that the employee’s work performance or value to the County will be enhanced as a result of the course of study. Courses taken as part of a program of study for a college undergraduate or graduate degree will be evaluated individually for job relatedness under the above described criteria. The employees must agree in writing to continue working for the County for at least the following minimum periods of time after expiration of the leave of absence:

Length of Leave of Absence Period of Obligated Employment

44 to 65 workdays 52 biweekly pay periods

22 to 43 workdays 26 biweekly pay periods

6 to 21 workdays 13 biweekly pay periods

21.9 Absence Without Leave

(1) Refusal of Leave or Failure to Return After Leave: Failure to report for duty after a leave of absence request has been disapproved, revoked, or canceled by the appointing authority, or at the expiration of a leave, shall be considered an absence without leave.

(2) Absence Without Leave: Absence from duty without leave for any length of time without a satisfactory explanation is cause for dismissal. Absence without leave for 4 or more consecutive days without a satisfactory explanation shall be deemed a tender of resignation. If within thirty (30) days after the first day of absence without leave a person who has been absent makes an explanation satisfactory to the Board of Supervisors, the Board may reinstate such person.

21.10 Bereavement Leave

The County will provide up to twenty-four (24) hours paid bereavement leave upon the death of an employee’s parent, step-parent, spouse, domestic partner, child (including through miscarriage or stillbirth), stepchild, sibling, sibling-in-law, parent-in-law, step-parent in-law, grandparent, grandparent-in-law or grandchild.

In addition, employees may utilize accrued sick leave pursuant to Section 20.2 (4).

22.1 Payment of Healthcare Premiums – Regular Full Time Employees

The County and covered employees share in the cost of health care premiums. The County will pay 85% of the total premium for the Kaiser HMO, Blue Shield HMO, or Kaiser High Deductible Health Plans (employees pay 15% of the total premium) and the County will pay 75% of the total premium for the Blue Shield POS Plan (employees pay 25% of the total premium).

For full time employees enrolled in the Kaiser or Blue Shield High Deductible Health Plan, the County will annually contribute fifty percent (50%) of the cost of the deductible amount for the plan to a Health Savings Account. For part time employees working half time or more, the County’s contribution to the Health Savings Account shall be prorated based on their part time status.

22.2 Permanent Part Time Employees

For County employees occupying permanent part-time positions who work a minimum of forty (40), but less than sixty (60) hours in a biweekly pay period, the County will pay one-half (1/2) of the hospital and medical care premiums described above.

For County employees occupying permanent part-time positions who work a minimum of sixty (60), but less than eighty (80) hours in a biweekly pay period, or qualify for health benefits under the Affordable Care Act (ACA), the County will pay eighty-five percent (85%) of the Kaiser High Deductible Health Plan (HDHP) or three-fourths (3/4) of the County contribution to hospital and medical care premiums described above.

Upon request from the County, the parties will reopen Section 22 during the term of the agreement if necessary to address changes required under the ACA.

22.3 Sick Leave Conversion to Health Coverage Upon Retirement

Unless otherwise provided in this MOU, employees hired prior to January 23, 2011 whose employment with the County is severed by reason of retirement during the term of this MOU shall be reimbursed by the County for the unused sick leave at time of retirement on the following basis:

For each 8 hours of unused sick leave at time of retirement, the County shall contribute towards one month’s premium for health or dental coverage for the employee and eligible dependents (if such dependents are enrolled in the plan at the time of retirement). The County shall not be obligated to contribute at a rate in excess of $420.00 per 8 hours of unused sick leave per month for the retired employee to continue health or dental coverage (e.g., if an employee retires with 320 hours of unused sick leave, the County will continue to pay the health or dental premiums for a period of 40 months). Employees may increase the number of hours per month to be converted up to a maximum of 14 hours of sick leave per month. Such conversion may be in one full hour increments above a minimum of eight hours (e.g., if an employee converts 12 hours, they would be reimbursed $610.00 instead of $420). The number of hours to be converted shall be set upon retirement and can be changed annually during open enrollment, or upon a change in family status that impacts the number of covered individuals (e.g., death of spouse, marriage and addition of spouse).

For employees who retire with 20 or more years of service with the County of San Mateo, the $420 rate will be increased by 4% effective January 1, 2009 and each January 1st thereafter, the rate will be increased by 4%. Such contribution shall not exceed 90% of the Kaiser Employee-only premium.

For employees who retire with at least 15 but less than 20 years of service with the County of San Mateo, the $420 rate will be increased by 2% effective January 1, 2009 and each January 1st thereafter, the rate will be increased by 2%. Such contribution shall not exceed 90% of the Kaiser Employee-Only premium.

For employees who retire after January 1, 2009 with less than 15 years of service with the County of San Mateo, the conversion rate for each 8 hours of sick leave will be increased to $440.

Employees hired prior to January 23, 2011, who retire on or after January 1, 2007 with 20 or more years of service with the County of San Mateo, the 8 hours of sick leave converted for each month’s retiree health contribution by the county shall be reduced to 6 hours.

Employees hired on or after January 23, 2011 receive $400 per 8 hours of accrued sick leave. No inflation factor and no conversion at a lower number of hours based on years of service. See Section 22.5.

Should a retired employee die while receiving benefits under this section, the employee’s spouse and eligible dependents shall continue to receive coverage to the limits provided above.

22.4 Additional Sick Leave Credit Disability Retirement

The County will provide up to a maximum of 288.6 hours of sick leave (3 years of retiree health coverage) to employees who receive a disability retirement. For example, if an employee who receives a disability retirement has 100 hours of sick leave at the time of retirement, the County will add another 188.6 hours of sick leave to their balance.

Employees hired on or after January 23, 2011, whose employment with the County is severed by reason of retirement during the term of this MOU shall be reimbursed by the County for the unused sick leave at time of retirement on the following basis:

For each 8 hours of unused sick leave at time of retirement, the County shall contribute toward one month’s premium for health or dental coverage for the employee and eligible dependents (if such dependents are enrolled in the plan at the time of retirement.) The County shall not be obligated to contribute at a rate in excess of $400 per 8 hours of unused sick leave per month for the retired employee to continue health or dental coverage (e.g., if an employee retires with 320 hours of unused sick leave, the County will continue to pay towards the health or dental premiums for a period of 40 months.)

Employees who waive retiree health/dental coverage including COBRA rights may, upon retirement, convert each 8 hours of accrued sick leave for $100. Should this cashout be determined, either through legislative or judicial action, to constitute compensation earnable for retirement purposes, this provision shall become null and void. Effective January 1, 2007, employees will no longer be offered the option of cashing out sick leave if they waive retiree health. However, if it is determined to not create a taxable event and if it does not cause the above retiree health plans to become taxable events, then employees may exchange unused sick leave at a value of $100 per 8 hours into an RHSA upon retirement

22.5 Sick Leave Conversion – Survivor Benefit

The surviving spouse of an active employee who dies may, if they elect a retirement allowance, convert the employee’s accrued sick leave to the above specified limits, providing that the employee was age 55 or over with at least 20 years of continuous service.

22.6 Additional Sick Leave Credit

Employees who retire after March 31, 2008 will, upon exhaustion of accrued sick leave, be credited with additional hours of sick leave as follows:

(1) With at least 10 but less than 15 years of service with the County of San Mateo – 96 hours

(2) With at least 15 but less than 20 years of service with the County of San Mateo – 192 hours

(3) With 20 or more years of service with the County of San Mateo – 288 hours

22.7 Out of Area

Retirees who live in areas where no County Health Plan coverage is available, and who are eligible for conversion of sick leave credits to a County contribution toward health plan premiums, may receive such contribution in cash while continuously enrolled in an alternate health plan in the area of residence. It is understood that such enrollment shall be the sole responsibility of the retiree. This option must be selected either:

(1) At the time of retirement, or

(2) During the annual open enrollment period for the County’s health plans, provided the retiree has been continuously enrolled in one of the County’s health plans at the time of the switch to this option.

Payment to the retiree will require the submission to the County of proof of continuous enrollment in the alternate health plan, which proof shall also entitle the retiree to retain the right to change back to any County-offered health plan during a subsequent open enrollment period.

Out-of-area retirees who have no available sick leave credits for conversion to County payment of health premiums may also select the option of enrollment in an alternate health plan in the area of residence provided that no cash payment will be made to the retiree in this instance. Should such retiree elect this option during an open enrollment period rather than at the time of retirement s/he must have had continuous enrollment in a County-offered health plan up to the time of this election. Continuous enrollment in the alternate plan will entitle the retiree to re‑enroll in a County-offered health plan during a subsequent open enrollment period.

It is understood that the County is actively seeking coverage for out-of-area retirees under a nationwide HMO or other health insurance plan and that, should such coverage become available during the term of this MOU, the County will meet with the Union regarding substitution of this plan for the arrangement described in this subsection 22.5. Upon agreement by both the County and employee organizations such new plan will replace the cash option.

22.8 Deferred Compensation Automatic Enrollment for New Employees

Subject to applicable federal regulations, the County agrees to provide a deferred compensation plan that allows employees to defer compensation on a pre-tax basis through payroll deduction. Effective January 1, 2016, each new employee will be automatically enrolled in the County’s Deferred Compensation program, at the rate of one percent (1%) of their pre-tax wages, unless he or she chooses to opt out or to voluntarily change deferrals to greater than or less than the default one percent (>1%) as allowed in the plan or as allowed by law. The pre-tax deduction will be invested in the target fund associated with the employees’ date of birth. All deferrals are fully vested at the time of deferrals; there will be no waiting periods for vesting rights.

The County will continue to offer dental care coverage for the employees and their eligible dependents. The County will pay 90% of the premium for this coverage.

The County shall provide vision care coverage for employees and their eligible dependents. The County will pay the entire premium for this coverage.

Optional additional benefits may be available during open enrollment at an additional cost to the employee.

25.1 Benefits Committee

During the term of this MOU, the County and Unions shall convene the Benefits Committee for the following purposes:

(1) To continue ongoing discussions regarding cost structures as a part of an overall strategy to maintain balanced enrollment in County plans,

(2) To investigate the feasibility of revising medical and/or dental coverage and/or plan(s) and strategies to integrate wellness program participation into benefit insurance cost structure, and

(3) To address legislative changes to health insurance legislation, including, but not limited to, the Affordable Care Act.

The Benefits Committee will be composed of County labor representatives, not to exceed two (2) representatives from each participating labor organization and four (4) County representatives. The Union may designate an alternate representative to attend meetings when a regular representative is unavailable.

25.2 Benefits Levels

During the term of this agreement, the County agrees to continue all benefits programs at current benefits levels as listed in the MOU and the Benefits Summary.

25.3 Agreement Implementation

Agreements reached as part of the Benefits Committee may be implemented outside of negotiations if employee organizations representing a majority of employees agree, providing, however, all employee organizations are given an opportunity to meet and confer regarding such agreements.